Smart lighting market size

Smart Lighting Market Analysis

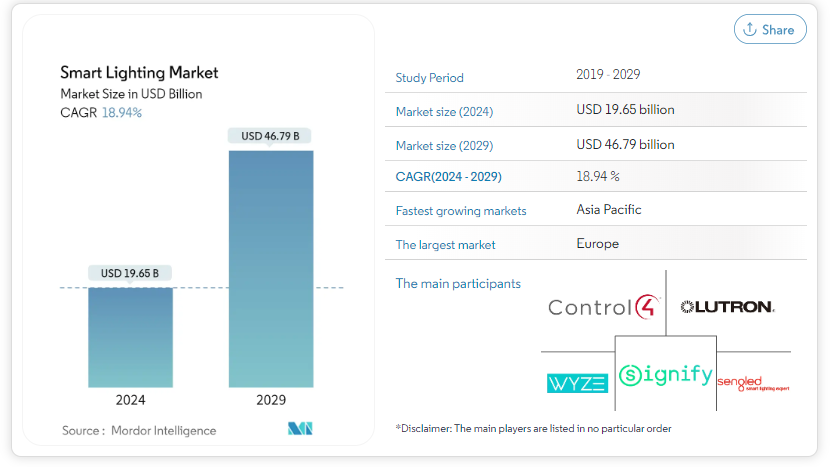

The smart lighting market size is expected to be USD 19.65 billion in 2024 and is expected to reach USD 46.79 billion by 2029, with a CAGR of 18.94% during the forecast period (2024-2029).

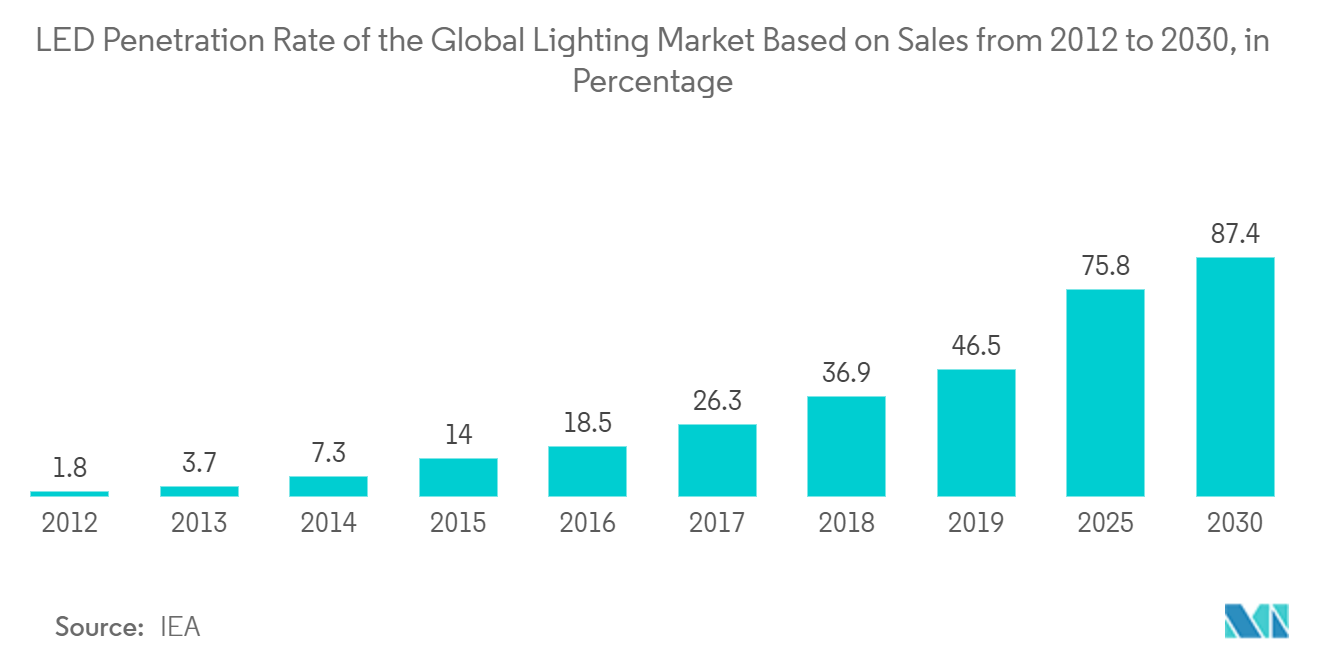

Because of its social benefits, consumers are likely to adopt energy-efficient LED technology more quickly, thereby accelerating the replacement of inferior compact fluorescent or halogen lighting technologies.

The popularity and demand for lights in both commercial and residential spaces is growing due to their ability to connect with IoT devices and produce a variety of ambient lighting using just a smartphone or tablet. Smart lights can dim in different shades depending on the situation, schedule their on/off times, track their energy consumption, and connect to other devices via Wi-Fi, Bluetooth, SmartThings, Z-Wave, or ZigBee.

Office spaces are also becoming one of the most common smart lighting applications. In today’s business world, owners and managers place greater emphasis on the overall well-being of their employees. By switching to smart lighting, offices can provide brighter lights for their employees. This helps them see more clearly and reduces eye strain. Additionally, the color of the light can help brighten the mood and provide a sense of comfort.

Furthermore, favorable government regulations regarding traditional lighting and energy consumption in the U.S., EU, China, and India are expected to favor the market demand for connected LED lighting.

However, the slow growth of the smart lighting market may bring entrepreneurial challenges. The consequences of a smart lighting product manufacturer's failure to enter the market include significant investment sinking and damaged reputation. To address these issues, manufacturers find it necessary to consider consumers' views on smart home technology, especially smart lighting products.

The emergence of COVID-19 has led to production stoppages and disruptions across the supply chain, hurting industrial output growth and reducing light manufacturing capacity in important manufacturing centers. However, as people spend more time at home, they are more inclined to upgrade their interiors, which has a positive impact on the market. In addition, the increasing use of LEDs in homes and the penetration of smart home technology are expected to further drive market growth in the coming years.

Smart lighting market trends

Government regulations mandating the use of LEDs drive the market

Government regulations mandating the use of LEDs are driving market demand in multiple regions. For example, in the United States, the most common types of light bulbs are legally mandated to have an energy saving rate of 45 lumens per watt, with a typical 60-watt incandescent bulb providing approximately 15 lumens per watt, and a halogen incandescent bulb providing 15 lumens per watt. CFL bulbs provide approximately 20 lumens per watt, CFL bulbs provide 65 lumens per watt, and LEDs provide 80-100 lumens per watt, while consuming very little energy. In addition, the decline in LED prices has led to a further increase in the adoption of smart lighting.

Through performance standards, labeling, and incentive programs, many governments around the world are moving quickly to phase out inefficient light sources, such as Europe, which began the switch to LED technology more than a decade ago. Recent EU updates to the Ecodesign Directive and the Restriction of Hazardous Substances Directive will effectively phase out all fluorescent lamps by 2023. In addition, the Ukrainian government announced in January 2023 that it had approved a plan to replace incandescent bulbs with electric light-emitting diode (LED) bulbs. This move is part of the EU's support for Ukraine's energy front.

The 16 African countries that make up the Southern African Development Community (SADC) have adopted a regionally harmonized lighting standard. The market for this standard will fully transition to LEDs in the coming years. The East African Community (EAC) is also phasing out fluorescent lamps in six of its member countries. Other jurisdictions, including Southeast Asian countries, are also implementing similar regulations. This is expected to drive the growth of the market studied.

According to the U.S. Department of Energy, widespread use of LED lighting is expected to have a significant impact on energy savings in the U.S. As a result, many lighting installations are expected to incorporate LED technology, and by 2035, annual energy savings from LED lighting could reach 569 TWh, equivalent to the annual power generation of approximately 92 1,000 MW power plants.

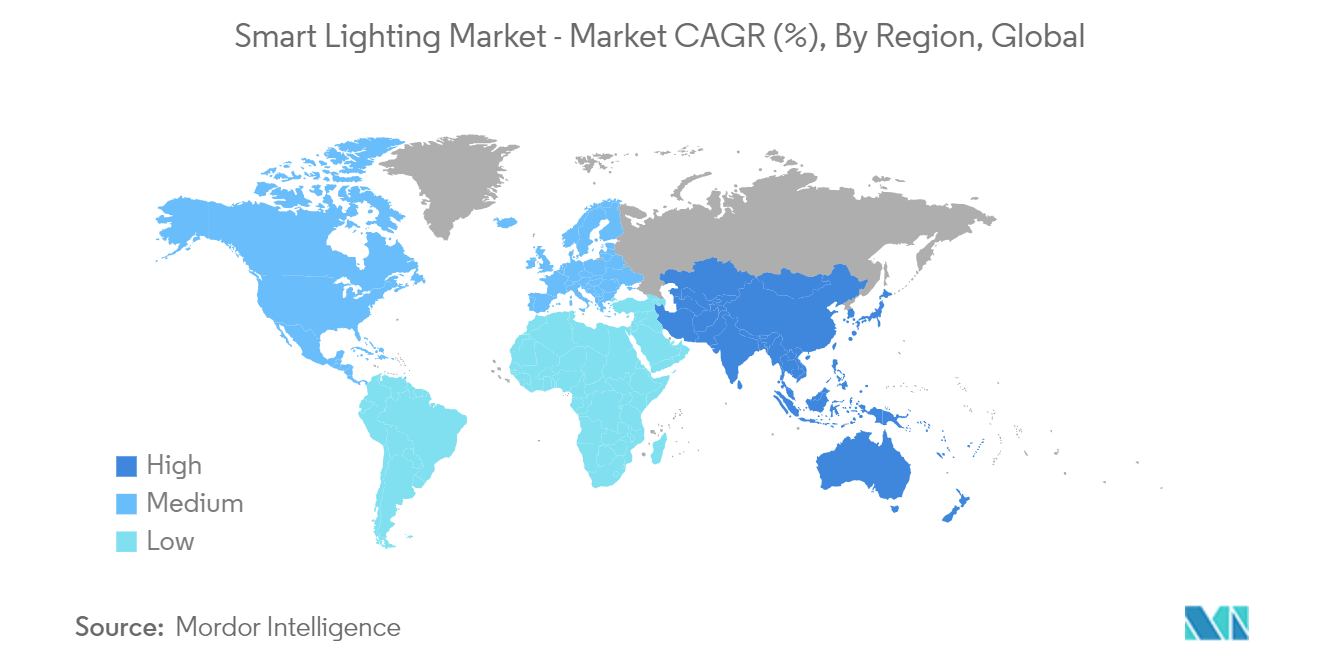

Asia Pacific region has the fastest growth

The growing popularity of the Internet of Things (IoT) is expected to illuminate the development of the Chinese lighting market, thereby promoting the growth of connected smart lighting systems in the country. GSMA estimates that by 2025, China is likely to have about 4.1 billion IoT connections, accounting for almost one-third of the global IoT connections. Smart lighting systems are expected to be the biggest beneficiary of this trend during the forecast period.

Global technology giants such as Google and Amazon have launched a series of smart home products tailored for the Japanese market. Against the backdrop of a year-on-year decline in the penetration rate of traditional home appliances, the smart home industry has unlimited potential in the future as artificial intelligence products and services are increasingly integrated into homes.

The country’s smart lighting market is also driven by the growing adoption of smart devices, including smartphones, as they can easily connect to IoT devices. The Japan Smartphone Security Association (JSSEC) estimates that the number of smartphone users in the country could reach 68.8 million by 2022.

The demand for smart lighting in India is expected to grow due to the increasing demand for features such as voice recognition or remote operation and superior experience of smart home automation. The increasing adoption of LED lights in various sectors such as residential, healthcare, and commercial spaces such as hotels and workplaces, and rising disposable income are other factors that are likely to drive the growth of these devices in the future.

Under the Asia Pacific region, other countries such as South Korea, Thailand, Singapore, Malaysia, Sri Lanka, Bangladesh, Australia, Indonesia, etc. also have great potential to gain a considerable share in the smart lighting market.

Overview of the Smart Lighting Industry

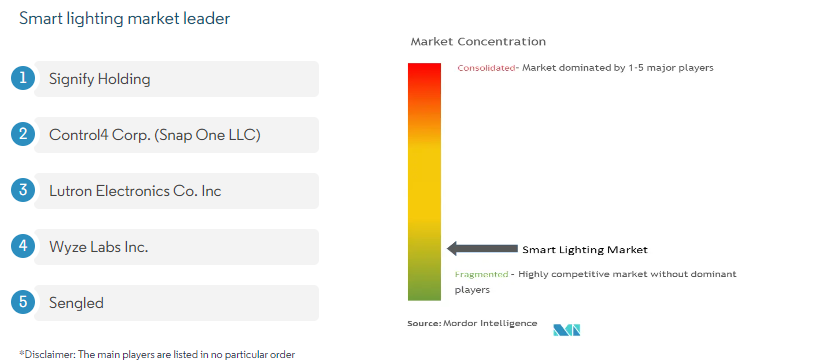

The smart lighting market is highly competitive and consists of several major players. However, many companies are expanding their market share of smart lighting by signing new contracts and acquiring other companies. Signify Holding, Control4 Corp. (Snap One LLC), Wyze Labs Inc., Eaton Corporation, and Savant are the major players.

In February 2023, Signify helped the German city of Eichenzell become a future-proof smart city through smart streetlights. Its BrightSites solution brings fast wireless broadband connectivity to the city, enabling Eichenzell to meet the needs of next-generation IoT applications and future 5G densification. Signify installed LED lighting managed by the Interact City System. Eichenzell can continuously monitor and manage all lights through a single dashboard.

In January 2023, GE Lighting, a Savant company, announced the expansion of its smart home ecosystem, Cync. Cync launched its entire dynamic entertainment series, which includes 16 million colors, preset and custom light shows, on-device music synchronization, and other features. In addition, following the successful launch last year, Cync also expanded its Wafer lamp product line.

Source: https://www.mordorintelligence.com/zh-CN/industry-reports/smart-lighting-market